Regulators seem to enjoy playing Santa Claus around Christmas each year by gifting multiple regulatory mandates to the banking industry. Christmas 2023 was no different, as we witnessed a multitude of significant rules and consultations from regulators on either side of the Atlantic and Pacific, including a 400-page Treasury clearing mandate from the US Securities and Exchange Commission (SEC).

This article distills key takeaways from the SEC’s new rules as they expand mandatory central clearing in the US$26 trillion US Treasury market, mirroring the earlier Dodd-Frank Act swaps clearing reforms. By taking the 80 per cent of the Treasury market that is still uncleared and ultimately pushing it into the cleared territory, the rules will potentially translate into roughly US$1 trillion of daily trades handled by independent clearing houses.

Treasury Market Structure

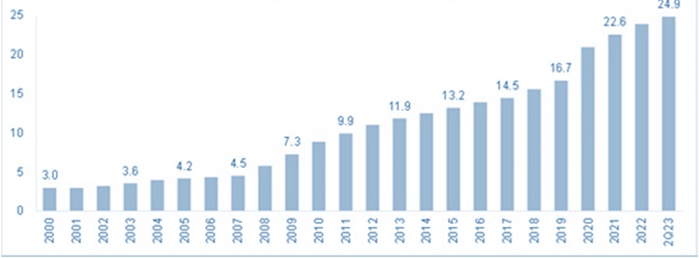

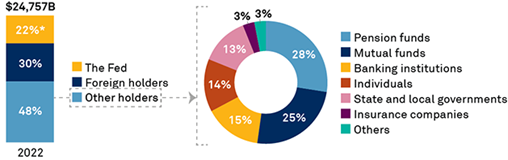

Over the last two decades, the US Treasury market has grown more than five-fold as the issuance of US government debt has continued to expand. Close to 60 per cent of this market is held by the Federal Reserve and foreign governments, with the remaining portion held between institutional investors (including pension funds, mutual funds, banks) and retail investors via retail accounts (wealth managers, private banks, high-net-worth investors).

Total Treasury Securities Outstanding (US$ Tn)

Source: Data from US Treasury, Monthly Statement of the Public Debt reports

US Treasury Securities by Market Participants

Source: Securities Industry and Financial Markets Association (SIFMA)

To determine the legal, operational and technology implications of the SEC’s Treasury clearing mandates, it certainly helps to understand the Treasury market microstructure, covering the products and participants. The US Treasury market is largely comprised of the following:

A. Cash market — for the outright purchase and sale of securities segmented into:

-

- An interdealer market, whereby both counterparties to the trade are dealers or market makers, including banks and non-banks, accounting for over 50 per cent of the cash Treasury market. Interdealer markets are dominated by principal trading firms (PTFs) that tend to use automated, high-speed strategies for electronic trading within the interdealer market. Trades between dealers are usually centrally cleared via a central counterparty clearing house (CCP).

- A dealer-to-client (D2C) market, whereby one counterparty to the trade is a net liquidity taker (i.e., asset manager, hedge fund, non-dealer bank). The D2C market is settled bilaterally via a clearing bank. The Treasury Market Practices Group has estimated that 13 per cent of cash transactions are centrally cleared, 68 per cent are bilaterally cleared, and 19 per cent involve hybrid clearing, in which one leg of a transaction on an interdealer broker (IDB) platform is centrally cleared and the other leg is bilaterally cleared.

B. Repo market — segmented into bilateral and triparty repo markets. The repo market is complex, with several different trading avenues for those in the industry. The US Treasury repo market can be segmented into four main trade type categories:

-

- Non-centrally cleared, settled bilaterally— This will be eliminated as the clearing mandates get enforced. A 2021 Federal Reserve Board report titled Hedge Fund Treasury Trading and Funding Fragility: Evidence from the COVID-19 Crisis, indicates that most hedge fund repo is transacted bilaterally, with only 13.7 per cent of this repo centrally cleared.

- Centrally cleared, settled bilaterally — The Fed has noted that approximately 20 per cent of all repo and 30 per cent of reverse repo is centrally cleared via the Fixed Income Clearing Corporation (FICC). In this model, cleared repo transactions between FICC members are executed electronically or by voice through IDBs. It is worth noting that FICC’s sponsored service allows for transactions between non-traditional institutional participants such as money market funds and hedge funds, with their obligation to FICC guaranteed by an FICC sponsoring member.

- Non-centrally cleared, settled on a triparty platform — This is a major funding market where the trade settlement between cash holders (i.e., money market funds) and dealers is facilitated by a clearing bank. Such transactions are settled at a clearing bank in custody and is not a counterparty to the transaction.

- Centrally cleared, settled on a triparty platform — Trades are cleared by FICC and settled on the BNY Mellon triparty platform. In September 2021, FICC also introduced a sponsored general collateral repo service in which centrally cleared repos between sponsored members and their sponsors are settled on the triparty platform.

Transactions in the futures market remain outside of the scope of the SEC Treasury clearing proposal, given that this is an exchange-traded and centrally cleared market and is interlinked to the cash and repo market via arbitrage. In terms of key market players offering Treasury clearing services, they can be segmented into:

FICC Clearing

- Sponsored member service (delivery-vs-payment, or DvP, and general collateral, or GC)

- Prime brokerage clearing

- Correspondent clearing

- Full-service netting membership

- Centrally Cleared Institution Triparty (CCIT) service

Repo Clearing

- LCH Group’s RepoClear — as a RepoClear member or dealer, or sponsored member.

- Eurex Repo — via general clearing or direct clearing membership, individual segregated account (ISA), direct clearing or ISDA Direct Indemnified clearing membership, clearing agent or Futures Commission Merchant (FCM) clearing member, whether disclosed or undisclosed.

Treasury Trading Models

Trading of Treasury securities can be fully electronic on a third-party e-trading platform with central limit order book (CLOB), RFQs, disclosed or anonymous, auction, dark pool, or crossing networks. The price transmission usually occurs via direct pricing streams, actionable indications of interest (IOIs), stream or click-to-engage whereby a particular security at a particular price is pushed to potential counterparties by dealers and market makers. Electronic trading accounts for two-thirds of US Treasury trading by notional value.

The trading can also occur via voice-processed platforms, where the price negotiation and trade matching takes place by phone, email or instant message with trades entered in an e-trading platform for post-trade processing.

US Treasury Clearing: What’s In, What’s Out?

Treasury transactions involving banks and broker-dealers leveraging IDB platforms are predominantly covered for clearing by FICC. These include all cash transactions (i.e., purchase and sale of Treasury securities between a direct participant and a counterparty, which could include registered broker-dealer, government securities dealer, government securities broker or interdealer trades).

This could also involve cash transactions between two non-FICC participants through an IDB, which needs to be cleared through FICC where the IDB is a FICC direct participant.

As for repos, both legs of the trade through FICC must be cleared. However, transactions involving hedge funds and principal trading firms (PTFs) leveraging interdealer broker platforms largely remain outside the scope of central clearing. Furthermore, repo transactions with some counterparties such as a central bank, sovereign entity, CCP, local or state government or a natural person (i.e., individual) are exempt from this clearing mandate. Even the inter-affiliate transactions conducted between affiliated entities within the same corporate group are excluded from the scope of the clearing mandate.

Operational, Technology and Legal Implementation

Under the Dodd-Frank reforms, a strong distinction was made between direct participants and indirect participants which traded via an intermediary such as a designated contract market. In the wake of various irregularities, Dodd-Frank required that margin be segregated between these two types of participants, such that an indirect participant’s margin payments and posted collateral could never be conflated with those of the primary dealer. The Treasury’s clearing reforms extend this same principle to the Treasuries market, maintaining a strong distinction between direct and indirect participants, and enforcing segregation of assets.

The operational, technology and legal impacts of the reforms on a given participant depend on the participant type. Direct participants are those which trade via the sponsoring member and agent clearing member models; indirect participants are those using the sponsored member and executing firm customer models. Depending on the model employed, the market participants are subject to a wide range of responsibilities.

Onboarding processes and documentation will be one source of cost. All participants will be required to create new trade agreements and new onboarding procedures, while sponsoring members will need to create a new onboarding procedure for each of their clearing relationships. Onboarding procedures will specify the sponsoring member agreement, member guarantee and authorisation from the relevant executing firm customers. Such paperwork will take a minimum of three to four months to prepare, with costs of up to US$150,000 to onboard a single broker. Legal documentation costs will be considerable for all participants, but especially those direct participants dealing with multiple customers.

The need to support new collateral obligations will impact operations teams and potentially affect the management of trade and counterparty data. Firms currently making uncleared Treasury trades will face significant costs implementing data and business logic changes around margin calculation, fees and haircut and eligibility tracking, as well as implementing processes to post and reconcile collateral. Firms already engaging in collateral or inventory optimisation will need to factor the new collateral obligations into that optimisation. Operations teams will need to consider maintaining new trade and client reference data to make determinations for appropriate central clearing and to identify exclusions, such as affiliate trades.

Direct participants will further be required to support collateral segregation, which will mean collecting client collateral separately and holding it in separate accounts from the direct participant’s collateral. Direct members accepting done-away trades will have additional concerns. The operations team will also need to update their processes to account for amendments to the SEC 15c3-3a customer protection rule, requiring the Treasury CCP to debit the margin and deposit in the customer reserve formula — thereby enabling broker-dealers to collect margin from their sponsored members and pass it on to the FICC.

In addition to these operational and process changes, there will be technology impacts since firms will need to build integrations with clients, custodians and the FICC, and these integrations will need their own control and reconciliation processes.

Implementation Timings

The SEC aims to adhere to the following implementation framework:

31 March 2025 — Go-live dates for FICC to implement:

- Safekeeping of customer assets (i.e., separation of client and house margins)

- Access to clearance and settlement services

- New risk management practices

- Amendments as it relates to 15c3-3a requirements

150 days after the rule is published in the Federal Register:

- FICC rule changes pertaining to the clearing of eligible secondary market transactions

31 December 2025:

- Eligible secondary market cash transactions to be cleared by direct participants of FICC

30 June 2026:

- Eligible secondary market repo transactions to be cleared by direct participants of FICC

Closing Comments

Broker-dealers that are, or plan to be, direct participants of FICC need to both enhance their customer clearing models and implement onboarding processes for clients that seek access to FICC via sponsored membership. Those brokers that currently clear their Treasury cash and repo trades bilaterally will need to select the direct or indirect FICC access model that is the most efficient fit for their strategy.

Buy-side participants will need to implement a process to calculate and post collateral, select an appropriate access model and reengineer their trading processes and broker relationships. Buy-side firms choosing direct access can be expected to make determinations around capital considerations, clearing funds and capped contingent liquidity facility obligations, while those choosing an indirect model will need to make choices such as gross or net margining and sponsored or agent clearing.

In either case, operational and technology changes will be required, though their precise scope will depend on a firm’s role and access model.

This article was originally published in the February 20, 2024, issue of Securities Finance Times.