- Source: American Banker

Treliant Takeaway:

Treliant is ready to assist your financial institution navigate the ever-evolving regulatory requirements associated with digital banking. We can assist with filling gaps to help with your company’s need for qualified professionals to deliver superior service to your clients or manage an assessment of your digital banking processes and systems.

Article Highlights:

On Friday, February 18, 2022, American Banker’s Penny Crossman reported that the digital behaviors of banking clients are changing how they interact with their banks.

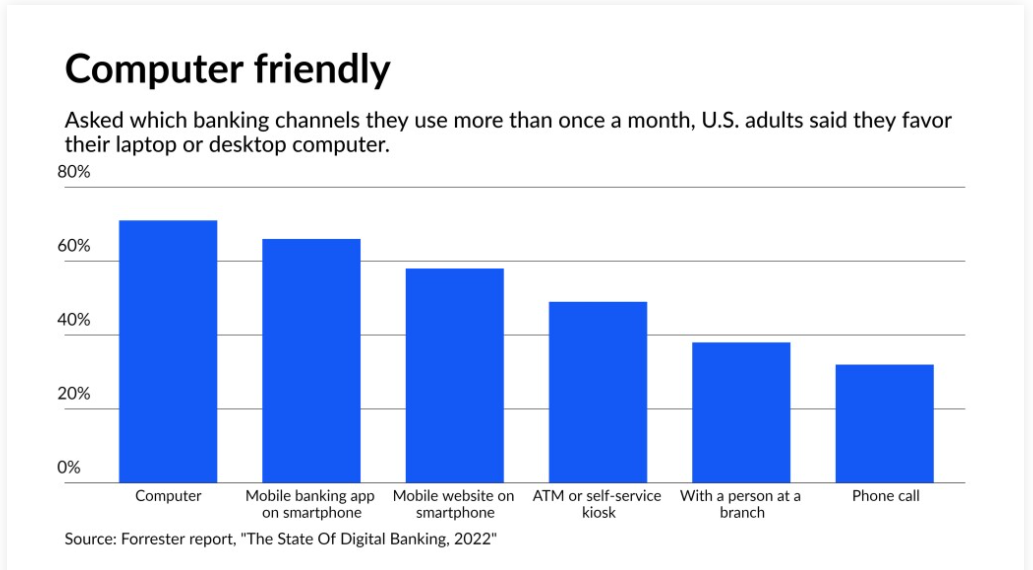

First and foremost, Americans still prefer online banking versus mobile banking, though that is slowly creeping up, and customers are also using smart speakers for basic inquiries into account balances, but there is an upward trend of consumers embracing mobile banking apps.

The article mentioned that mobile banking will eventually supplant online banking that will require more investment in mobile app development that can accommodate enhanced features.

Many people who visit their bank’s website tend to leave after viewing one area, which means enhanced security features may be desirable since forgotten passwords are the most likely reason behind site abandonment. This factor besides a shortage of technology workers to adequately manage digital operations indicates a large opportunity for banks to grow business. Smaller and medium sized banks will be well positioned for future growth by addressing technology enhancements sooner rather than later. As banks take the time to groom and develop in house staff resources, Treliant can step in sooner rather than later to address the changing face of digital banking.