Central bank digital currencies (CBDCs) have become a hot topic for the financial community. This article gives a high-level overview of the development of CBDCs in the European Union (EU), United Kingdom (UK), United States (US), and China, and reflects on potential models and prospects for the near future.

A CBDC is intended to function as digital cash. It would not replace banknotes and coins but serve alongside them as a supplementary means of payment. Among the market drivers for CBDCs have been a desire to avoid handling banknotes and coins, combined with the expanded availability of cashless payment options in shops and online shopping.

There are benefits to introducing CBDCs. However, there are also concerns that need to be considered and addressed.

Benefits

- Lower transaction costs for users of international payments compared to cash.

- Establishment of an efficient approach to reducing the costs of inter-bank settlements.

- Inclusion of competition in the payment system landscape.

- Improved digital payments solutions and stable currencies in a digital form (in comparison, cryptocurrencies are highly volatile and fluctuate).

- Robust data privacy aligning user information with regulatory requirements.

Concerns

- Geographic restrictions—only accepted in the country that issues the CBDC.

- Direct competition to current payment service providers (PSPs).

- Inconsistency of end-user data privacy on a global level.

- Limitations on access to technology platforms for all end-users.

| Digital Currency | Country / Region | Central Bank(s) | Announcement Year | Status |

| e-CNY | China | People’s Bank of China | 2017 | Pilot |

| Digital Euro | European Union | Eurosystem (the European Central Bank and the National Central Banks of the Member States whose currency is the Euro) | 2020 | Research |

| United Kingdom CBDC | United Kingdom | Bank of England | 2018 | Research |

| RSCoin | United Kingdom | Bank of England | 2015 | Research |

| United States of America CBDC | United States of America | US Federal Reserve | 2020 | Research |

| Summary of Key Central Bank Digital Currency Developments | ||||

CBCD Models

Single-tier model: CBDC transaction resemble transactions with commercial banks, except accounts would be held with the central bank (CB). The end-user would log in to an account at the CB through a web or mobile application and request a transfer of funds to a recipient’s account, also at the CB. The CB would ensure settlements by updating a master ledger but only after verification of the payer’s authority to use the account, enough funds, and authenticity of the payee’s account. This mode gives the CB more control over the product design and implementation process. This approach would directly compete with existing digital payment service providers creating risk between PSPs utilizing such intermediaries.

Two-tier model: The CB issues CBDC but outsources some or all the work of administering the accounts and payments services. However, CBDC remains the liability of the CB, and CBDC holders would not be exposed to default risk of the engaged PSPs. The CB distributes CBDC to selected banks or payment platforms (distribution layer), who distribute CBDC to users through their payment systems layers. Broadly speaking the two-tier model concept is as follows:

CB issues digital currency as part of the monetary base (M0 money) to intermediaries such as commercial banks, or other authorized parties. Those intermediaries then distribute the digital currency to consumers (and businesses) for use:

Redemption of the digital currency to bank money then takes the reverse route.

Countries Developing a CBCD

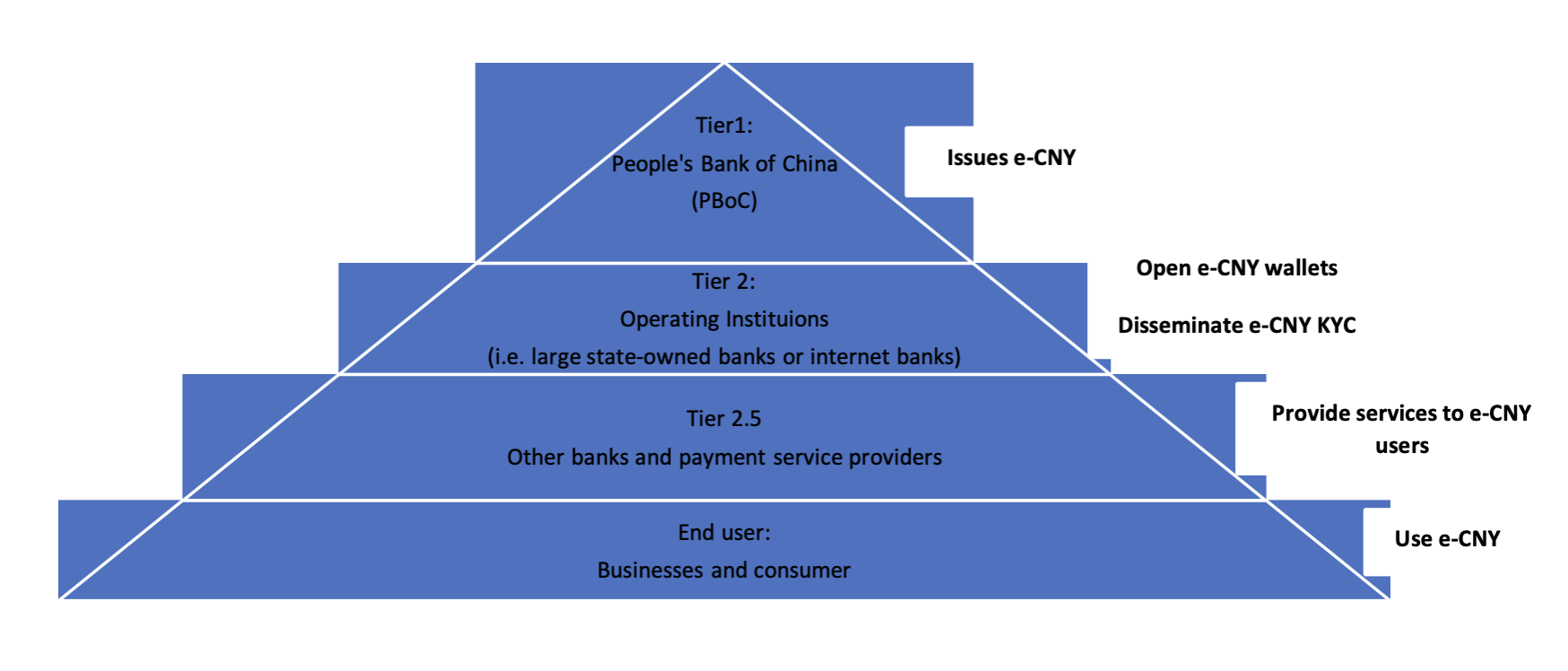

China has given the go ahead for its CBDC launch, with the People’s Bank of China (PBoC) gradually onboarding more provinces and cities to the e-CNY platform. China has deployed a two-tiered model. China’s CBDC features a hybrid operational system with two layers dealing with insurance and circulation, respectively. The CB distributes CBDC to selected banks or payment platforms, who distribute CBDC to users through their payment systems layers.

In the first layer, the PBoC issues e-CNY to second tier institutions, also called authorized operators, operating institutions, or “Tier 2 institutions.” Second tier institutions circulate the e-CNY to retail market participants including the public. Second tier institutions are also the e-CNY wallet providers. A user needs to go to one of the second tier institutions to open an e-CNY wallet, which usually involves an e-CNY wallet app.

Other banks and service providers are “Tier 2.5 institutions” that supply payment and other services to e-CNY holders but cannot provide e-CNY exchange services. They will join the e-CNY system to provide e-CNY circulation services and retail management, including innovation on payment product design, system development, scenario expansion, marketing, business processing, operation, and maintenance. Tier 2.5 institutions could process payments, but only Tier 2 institutions can provide exchange services.

Individuals or end-users will not be charged by commercial banks for e-CNY exchange and circulation services. The issue of fees collected by Tier 2 and 2.5 institutions on business is to be determined by the market. To ensure operational safety and reliability, the CB can leverage “market forces” to optimize related systems through close cooperation with commercial banks and other organizations, without imposing any prescriptive technology path in advance. This would facilitate resource integration, harmonious collaborations, and innovation, as well. Additionally, as the public are well used to dealing with commercial financial organisations, this could increase public acceptance of CBDC.

The proposed model would help to avert disintermediation in the financial sector.

Firstly, the CBDC based money issued to the public would remain the CB’s liability, backed by the CB’s credibility; the basis of qualification as legal tender also remains the same.

Secondly, the existing competition model and two-tier account structure model remain similar, avoiding disintermediation and potential liquidity issues. As the model has largely similar characteristics, behaviour in stress scenarios will also be relatively similar.

Lastly, the recommended model has the benefits of improved cost-effectiveness, better efficiency, and also provides support for more secure and user friendly payment services.

European Union: The digital euro benefits from a two-year experimental work program launched by Eurosystem (see table above) in October 2021. The goals are to address critical issues regarding the design and distribution of the digital euro, the potential impact on the market, data privacy, and necessary changes to the European legislation.

The Eurosystem is assessing design options that would prevent people holding substantial amounts of digital euro as a risk-free investment or shifting funds away from bank deposits to a digital euro. Once digital euro holdings are remunerated, the remuneration of individuals’ holdings for basic retail use in payments (i.e., single tier) would be zero or positive and therefore never worse than that of cash. The remuneration of “two tier” should be a certain level below that of assets that are considered safe, to avoid a digital euro becoming a form of investment, since CB money is the asset that best combines safety and stability.

Our interpretation on the EU’s stance, is they are leaning toward the two-tier model based on the following: “The way we pay is becoming increasingly digital. To ensure financial stability in this digital age, it is crucial that we all still have easy access to central bank money, which is the foundation of our currency. The digital euro can achieve that.”1 A digital euro would allow people to make payments without sharing their data with third parties, other than what is required to prevent illicit activities. For payments to remain a private matter, diverse types of data would need to be protected: the user’s identity, data on the individual payment (e.g., its amount), and metadata related to the transaction (e.g., the IP address of the device used for the transaction). Users will have to identify themselves when first accessing digital euro services, but different degrees of privacy can still be maintained for their payments.

United Kingdom: The Bank of England (BoE) has not decided whether to go ahead with a digital currency and is still in an exploratory phase. In April 2021, the BoE and the HM Treasury set up two forums to help with their investigations regarding a UK digital currency: The CBDC Engagement Forum and CBDC Technology Forum. Interestingly, Tom Mutton, director of FinTech at the BoE, has recently stated that although the primary vehicle for use of CBDC is expected to be smartphones, prepaid cards are also being explored to ensure access for those without smartphone technology.

The BoE added that a UK digital pound is not likely to arrive until 2025 at the earliest.2

On July 6 of this year, Deputy Governor Jon Cunliffe, who is overseeing the BoE’s work on CB digital currencies, stated that, “We will produce the asset and the rails, but the interface with the public would actually be done by private-sector payment providers,” and that, “It could be banks that will have the customer accounts payable to integrate money into their digital applications.” Still, “There are other models. One model is we allow the private sector to do the tokenization, to provide their own money that we back one-for-one with CB money.”3 This would align with the hybrid CBDC model approach taken by the US and China.

The CBDC Engagement Forum looks at all aspects of a CB digital currency apart from the technology it might use. The focus of this forum is to understand the practical challenges of designing, implementing, and operating a CBDC, e.g., use cases, functional needs, and financial and digital inclusion. The forum’s members come from financial institutions, civil society groups, and merchants.

The CBDC Technology Forum looks at the technology a CB digital currency might use. The focus of this forum is to involve people with a wide range of expertise and perspectives to understand the technological challenges of a designing, implementing, and operating a CBDC. The forum’s members come from a range of financial institutions, universities, FinTechs, infrastructure providers, and technology firms.4

The BoE is engaging with several international partners and organizations on their findings and analysis (such as the Bank for International Settlements and G7 CBs and finance ministries), since “strong international coordination and cooperation on these issues helps to ensure that public and private sector innovation will deliver domestic and cross-border benefits while being safe for users and the wider financial system.”5

As of 2021, no G7 authority had yet declared whether it will issue a CBDC.

United States: There is some apprehension to a CBDC in the U.S. relating to commercial banks, since they are concerned that their role as deposit takers could be undermined by a CBDC that would be “gilt edged.” Federal Reserve Governor Jerome Powell has defended the slow pace on CDBC by arguing that the U.S. payments system works effectively.

The private sector would offer accounts or digital wallets to facilitate the management of CBDC holdings and payments. Using this model would facilitate the use of the private sector’s existing privacy and identity management frameworks, leverage the private sector’s ability to innovate, and reduce the prospects for destabilizing disruptions to the well-functioning U.S. financial system.6 The U.S. would therefore follow the hybrid model (two-tier) approach.

In 2022, the topic of a general-purpose Fed digital dollar is still very much in debate, and no decision has been made as regards issuance of a CDBC, for use in U.S. payment systems. If it were decided to issue CBDC in the U.S., it would require clear support from the executive branch and from Congress, ideally in the form of a specific authorizing law.7 The Federal Reserve is studying the development of a digital dollar for public use and will publish a discussion paper later this year.8

Key Takeaways

Current international efforts regarding CBDC initiatives revolve around CBDCs’ designs, underlying technologies, and benefits. The argument arises that CBDC has the potential to create synergies with private payment solutions and contributing to an innovative, competitive, and resilient payment system across the globe. Its adoption would digitalize the economy and facilitate further innovation in payments and monetary systems. This could create more efficient, robust, and secure cross-border payments ensuring

smooth capital flow internationally. The global adoption of digital currencies by emerging market economies may promote financial inclusion, especially for the non-banked population. The essential success of CBDC depends on its functionality as a better, more efficient, and more stable medium of exchange.

Things to look forward to:

- The building of stronger international governance and relations.

- A global platform for countries to access currency systems and economic development.

- Reduction of identified data privacy risk exposure for end-users.

- Establishment and implementation of CB regulatory requirements globally for CBDCs.

- Development of technology infrastructure to support digital currencies.

- An answer on whether there will be an established global approach available and which countries will adopt this approach.

And some interesting points:

- Statistics released by the ECB for 2021 stated that the “total number of non-cash payments in euro area increased by 12.5% to €114.2 billion” (US$114.3 billion)9

- China’s digital yuan trial reached a staggering $5.3 billion in transactions using the virtual wallet by mid-July 2021, with an expectation of reaching 140 million people by end of September 2021.

- With the rapid increase in users and volumes of payments reflected within the EU and China markets alone, CBs will have to develop rapidly to keep pace with the demands of digital consumers.

1 https://www.ecb.europa.eu/press/blog/date/2022/html/ecb.blog220713~34e21c3240.en.html

2 UK central bank digital currency | Bank of England

3 UK Digital Pound Won’t Work Like Cash Banknotes, Bank of England Says on CBDC – Bloomberg

4 UK central bank digital currency | Bank of England

5 FINAL_G7_Statement_on_Digital_Payments_13.10.21.pdf (publishing.service.gov.uk)

6 https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf

7 Money and Payments: The U.S. Dollar in the Age of Digital Transformation (federalreserve.gov)

8 Federal Reserve Board – Central Bank Digital Currency (CBDC)

9 Payments statistics: 2021 (europa.eu)

This article was co-authored by:

Allen Moy

Allen Moy has more than 15 years of management consulting and industry experience. His focus is on designing risk management programs in the market risk areas for leading firms in the financial services industry. He possesses product skills in the areas of asset/liability management, treasury and capital markets, derivative products, and retail & wholesale banking in multiple regulatory and cultural environments in the United States, APAC, the United Kingdom and across Europe.

Eimear Clancy

Eimear Clancy is a Senior Consultant with Treliant. Her professional experience on regulatory change initiatives includes Brexit, Margin Requirements for Non-Centrally Cleared Derivatives and helping a Global Tier 1 Bank fulfil its consent order obligations. Prior to joining Treliant, Eimear worked as a consultant on loan sales in Dublin before moving to New York. Eimear graduated from the University of Galway with a Bachelor of Commerce (International).